(Seguin) — The Seguin ISD is hoping that voters will consider lowering the tax rate, which will ultimately help the district emerge from a financial bind. During Tuesday’s election, the district will be hosting a Voter Approval Tax Ratification Election (VATRE). It appears on the ballot as approval of Proposition A.

Seguin ISD Chief Financial Officer Liz Oaks says approval of Proposition A will lower the tax rate, but more importantly, it will let the district receive more money from the state.

“I don’t think it’s any secret that school districts have been struggling financially for a long time, but there has been no increase to the basic allotment, which is the basis of the per pupil state funding that we received since 2019. So, we’re essentially operating on 2024 bills with 2019 revenue. Most districts in the state of Texas have adopted a deficit budget for several years now, and Seguin ISD falls into that category. For the 2024-2025 school year, the district adopted a $4 million budget deficit. So, the board of Trustees is tasked with finding a way to get out of that deficit, and we, as a school district, are doing three things to try to fix that problem with one of the solutions being the election,” said Oaks.

“I don’t think it’s any secret that school districts have been struggling financially for a long time, but there has been no increase to the basic allotment, which is the basis of the per pupil state funding that we received since 2019. So, we’re essentially operating on 2024 bills with 2019 revenue. Most districts in the state of Texas have adopted a deficit budget for several years now, and Seguin ISD falls into that category. For the 2024-2025 school year, the district adopted a $4 million budget deficit. So, the board of Trustees is tasked with finding a way to get out of that deficit, and we, as a school district, are doing three things to try to fix that problem with one of the solutions being the election,” said Oaks.

Some of the other things the district has done is try to tighten its belt. Oaks says they are reducing expenses to help reduce that deficit.

School Board Trustee Josh Bright says they also have limited salary expenses for this year, that includes not providing pay raises this school year. He says the steps they are taking now are just the beginning if the proposition fails. He says they need the additional revenue to help pay teachers and to help provide the best educational experiences for all students.

“That’s one of the reasons why, when this came up before us, as the board, we’re like — ‘yeah, let’s do it!’ We’ve got to get this so that we can take care of our staff, and this will also take care of some programs. Unlike bond money that we’ve asked for in the past, this one doesn’t go to facilities. This one goes to our people, and it goes to student programs,” said Bright.

The district officials have been trying to explain why Proposition A needs to be approved, but they have also tried to explain how this will work. The approval of Proposition A would lower the current maintenance and operation tax rate. Bright says your appraisal might still go up, which is beyond the school district’s control. He says what they can control is the tax rate and that would be lowered by 1.38 cents to $1.1028. “We’re talking about lowering the tax rate.

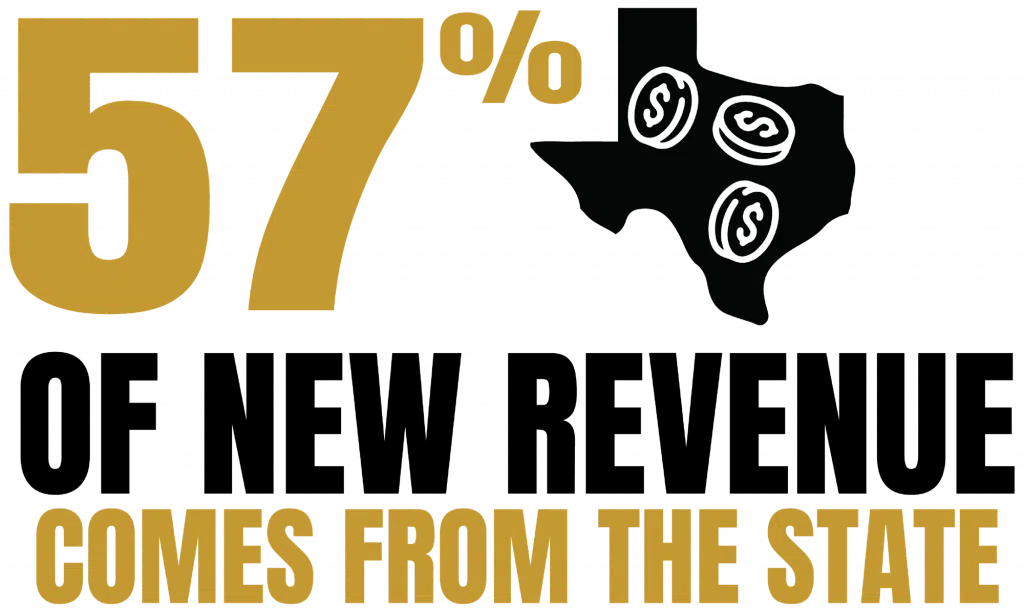

We’re not asking people to come out of pocket and pay us anymore. Because of legislation, we have to ask the voters to approve a lower tax rate, which will take in more money from the state. We’ll get more money from the state and less money from the local people,” said Bright.

It becomes more complicated when trying to explain how lowering the tax rate will lead to more revenue for the district. Oaks says it’s based on the state’s funding formula. She says school districts have been required to lower their tax rates for years now, but in this case, there would be an opportunity for the Seguin ISD to see its contributions from the state go up.

“Since House Bill 3 in 2019, there has been required tax rate compression to school districts in the state of Texas, that is dependent on their value growth compared to the statewide average. So, Seguin ISD has decreased the tax rate 34 cents since then. Our tax rate for last year was $1.1166. If Prop A passes, the tax rate will be $1.1028. So, it is a slight decrease from the prior year, the 2023 tax rate. We are able to do that because the tax rate compression is greater than the increase that we are essentially doing to get all of our what are called golden pennies. Golden pennies are worth more than any other part of our tax rate. The state basically guarantees for every one of those pennies that we are going to generate so much revenue per kid in attendance and we get to keep all of that money. So, Seguin ISD had six golden pennies. The most you can have are eight, and this, if passed, would give us all eight of those pennies,” said Oaks.

“Since House Bill 3 in 2019, there has been required tax rate compression to school districts in the state of Texas, that is dependent on their value growth compared to the statewide average. So, Seguin ISD has decreased the tax rate 34 cents since then. Our tax rate for last year was $1.1166. If Prop A passes, the tax rate will be $1.1028. So, it is a slight decrease from the prior year, the 2023 tax rate. We are able to do that because the tax rate compression is greater than the increase that we are essentially doing to get all of our what are called golden pennies. Golden pennies are worth more than any other part of our tax rate. The state basically guarantees for every one of those pennies that we are going to generate so much revenue per kid in attendance and we get to keep all of that money. So, Seguin ISD had six golden pennies. The most you can have are eight, and this, if passed, would give us all eight of those pennies,” said Oaks.

Oaks has been making factual presentations about Proposition A for weeks now. She and other members of the staff can’t encourage people to vote for or against it. However, that’s not the case for Bright. He and other members of the school board have been out front about the need for Prop A to pass, and he says he is again encouraging voters to invest in the district’s future.

“We are trying to do everything we can do to maintain what we have right now, and not lose any programs. We’re just trying to make it a better educational experience and allow all of our programs and students to be able to flourish and do what they can do. I know that our Seguin community will come through for us and for their children in this community to pass this proposition,” said Bright.

The polls will be open from 7 a.m. to 7 p.m. on Tuesday. Seguin ISD voters can cast their ballots at any voting location in Guadalupe County, and have their voices heard when it comes to the Voter Approval Tax Ratification Election.